The Benefits of Timely Reporting Foreign Inheritance to IRS and Its Effect On Your Funds

Timely coverage of international inheritance to the IRS can significantly affect a person's economic landscape. By recognizing the coverage requirements, one can stay clear of potential fines and lawful complications - Form 3520 foreign gift. Furthermore, there are tax benefits linked with timely declaring that could boost total monetary preparation. The ramifications of these actions can be far-reaching, impacting investment opportunities and property monitoring approaches. What continues to be to be checked out are the intricacies of global inheritance laws and their effects

Recognizing IRS Coverage Requirements for Foreign Inheritance

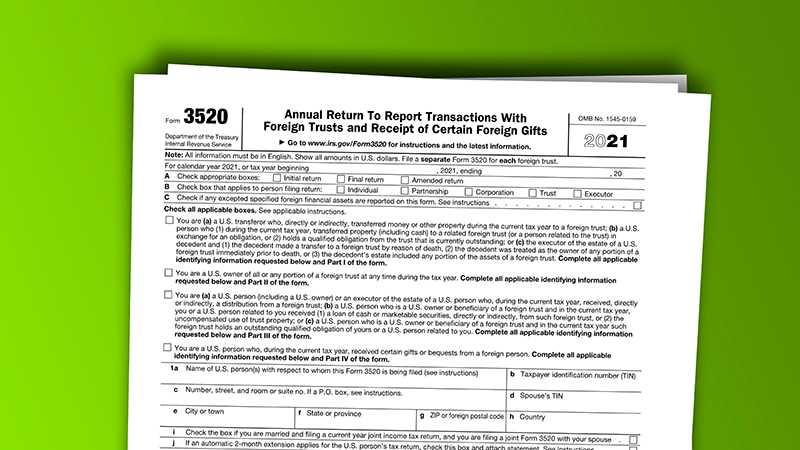

When individuals obtain an inheritance from abroad, they should navigate details IRS coverage needs to guarantee compliance. The IRS requireds that united state citizens and people report foreign inheritances surpassing $100,000 on Form 3520, which is due on the very same day as their revenue tax obligation return. This type records vital details regarding the inheritance, including the quantity received and the partnership to the decedent. Additionally, any foreign financial institution accounts related to the inheritance may call for reporting under the Foreign Bank and Financial Accounts (FBAR) laws if the accumulated worth surpasses $10,000. Comprehending these requirements is vital, as failure to record can lead to considerable penalties. Individuals must remain mindful of any kind of appropriate estate taxes that might emerge from international inheritances, specifically if the estate goes beyond specific limits. Appropriate adherence to these standards assurances that people manage their economic obligations effectively and prevent problems with the IRS.

Preventing Fines and Legal Issues

Steering through the intricacies of foreign inheritance reporting can be daunting, however recognizing the needs is crucial for staying clear of fines and legal problems. The IRS enforces stringent guidelines on reporting international inheritances, and failure to abide can lead to severe repercussions. Taxpayers should know kinds such as the FinCEN Kind 114 and IRS Kind 3520, which serve to reveal foreign presents and inheritances precisely.

Disagreement can cause substantial penalties, and sometimes, criminal fees may be gone after. In addition, unreported inheritances can complicate estate matters, leading to additional lawful complications. Precise and timely reporting not only alleviates these dangers but also promotes openness and count on with tax authorities. By focusing on conformity, people can focus on handling their newfound properties instead than navigating prospective lawful disputes or fines - foreign gift tax reporting requirements. Inevitably, comprehending coverage demands is necessary for keeping economic comfort

Potential Tax Obligation Benefits of Timely Coverage

Although the primary emphasis of reporting foreign inheritances commonly fixates compliance, prompt coverage can additionally expose possible tax benefits. By immediately divulging international inheritances to the IRS, individuals may have the ability to take advantage of details exceptions and reductions that could reduce their general tax obligation liability. For example, the IRS permits particular foreign inheritance tax credit reports that can balance out united state tax responsibilities. Furthermore, timely reporting may help with the use of the annual present tax obligation exemption, allowing recipients to disperse portions of their inheritance to friend or family without incurring added tax liabilities.

Moreover, very early coverage can offer clarity on just how the inheritance matches an individual's total monetary photo, potentially permitting calculated tax preparation. This proactive method reduces surprises and assists people make notified choices concerning their monetary future. Inevitably, recognizing these prospective tax advantages can greatly improve the economic benefits of acquiring international properties.

Enhancing Financial Preparation and Investment Opportunities

Timely coverage of international inheritances not only guarantees compliance with IRS laws yet additionally opens up avenues for boosted monetary planning and financial investment opportunities. When people disclose their inheritances immediately, they can tactically include these assets right into their general monetary portfolios. This positive approach enables far better assessment of total assets and promotes educated decision-making regarding financial investments.

Navigating Complexities of International Inheritance Rules

Navigating via the ins and outs of international inheritance laws can be difficult, as varying legal structures throughout countries usually bring about confusion and problems. Each jurisdiction more may enforce one-of-a-kind regulations pertaining to the circulation of properties, tax commitments, and needed documents, making complex the procedure for successors. This complexity is aggravated by the potential for conflicting legislations, especially when the deceased had possessions in multiple nations.

.jpg)

Frequently Asked Inquiries

What Kinds Are Needed for Coverage Foreign Inheritance to the IRS?

To report international inheritance to the IRS, people typically require to submit Form 3520, which reports foreign presents and inheritances, and might additionally need Type 8938 if international possessions exceed certain limits.

Exactly How Does Foreign Inheritance Influence My Estate Tax Obligation Commitments?

International inheritance may boost estate tax obligations depending on the overall worth of the estate and relevant exemptions. Correct reporting guarantees conformity with IRS guidelines, possibly influencing future tax obligation liabilities and estate preparation approaches.

Can I Obtain Foreign Inheritance in Installments?

What Is the Due date for Coverage a Foreign Inheritance?

The target date for reporting an international inheritance to the IRS is typically April website link 15 of the list below year after receiving the inheritance. Extensions might apply, yet prompt reporting is necessary to avoid penalties.

Are There Exceptions for Small International Inheritances?

Yes, there are exemptions for small foreign inheritances. Individuals may not need to report inheritances listed below a certain limit, which varies by territory. Consulting a tax specialist is recommended for details advice regarding individual situations.